“Inflation, the rise in price

That leaves us feeling not so nice

The value of money starts to fall

And we’re left with less, overall

We hope for better days to come

When prices will stabilize and become

Affordable once again

And we can breathe a sigh of relief, amen.”

– A poem about inflation, by the newly launched AI-powered chatbot ChatGPT

After a tough market environment in 2022 that saw the S&P 500 Index drop 19.4% in the worst year for equities since 2008, investors are trying to decide if 2023 will be markedly different or if the specter of recession will lead to further declines.

So far in 2023, the S&P 500 Index has risen more than 6%1. That’s encouraging, but we aren’t convinced that there won’t be further volatility in the months ahead as the Fed remains committed to wage war on inflation via continuing interest rate hikes.

1as of 2/16/23

Inflation: Slowing, but Persistent

When celebrities start complaining about the price of lettuce, you know inflation is a problem. Shortly after the new year, rapper Cardi B posted a rant on Twitter lamenting the cost of lettuce having risen from $2 to $7 in a matter of months. She then offered sage advice to deal with rising prices: stick to a budget, because if you don’t you’re “going to go broke soon.”

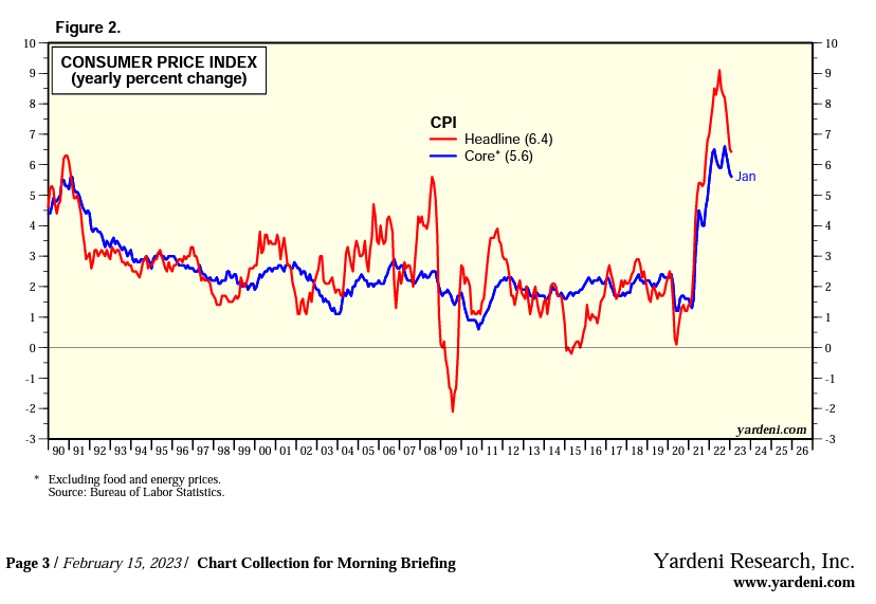

The good news for Cardi B (and the rest of us) is that inflation is reversing its steady climb. Inflation has proven responsive to the Fed’s interest rate hikes so far in 2023, though the pace of inflation’s moderation is slowing. January’s CPI measurement climbed 6.4% in January from a year earlier, down from 6.5% in December, according to the Labor Department.

This reinforces the message that Jerome Powell has steadily offered in his public comments. At the February Fed Meeting, Powell was clear: “Ongoing rate increases will be appropriate, and restoring price stability will require a restrictive stance for some time.” Investors so far this year have pushed equity valuations higher in the belief that inflation will be moderating faster than expected. We believe this could be wishful thinking.

Prepare for Landing

Economists are lining up to slap a label on how they see the economy faring in 2023. We’ve heard everything from an “earnings recession”, to “Patagonia vest recession” (taking aim at a favorite piece of Wall Street office apparel), to a “slowcession” (implying slowing growth without entering a formal recession, and even the mystifying “vibecession”, which suggests that negative talk about inflation could speak an actual recession into existence.

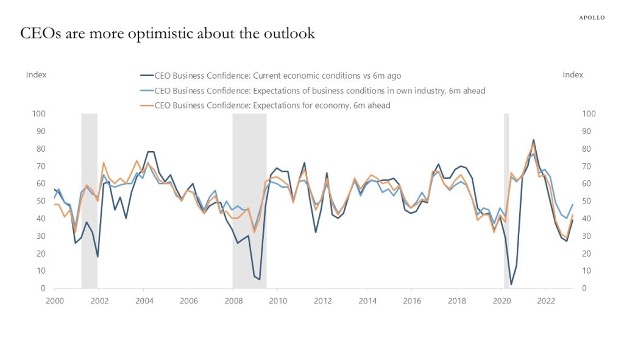

Colorful labels aside, the current debate centers around a few possible outcomes. One could be a soft landing, where the Fed is able to steadily bring inflation down to its target of 2%. If this transpires, the economy could ease back into its pre-pandemic form without a recession and a corresponding market spasm. Indeed, as sentiment and economic data have improved so far in 2023, this outcome has gone from unlikely to possible. As the chart below shows, CEO optimism is on the rise.

Source: The Conference Board, Haver, Apollo Chief Economist

The second possibility is less pleasant. A hard landing scenario would mean a strong recession and a significant market pullback, an unpalatable outcome with 2022’s declines still fresh in mind. This outcome would be fueled by inflation proving more persistent than the Fed has anticipated, forcing the Fed to raise rates higher and longer than currently expected, likely pushing the economy into recession to eventually slay rising prices.

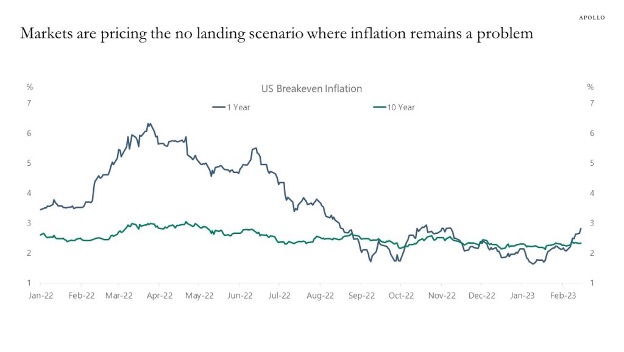

A new third option has emerged: The “no landing” scenario, in which inflation proves stubborn enough that the Fed raises rates through most of this year, but economic data and consumer spending remains resilient enough to avoid a recession in the near term. But this isn’t a rosy outcome either.

“Instead of expecting a recession and lower inflation, short-term inflation expectations are rising and becoming unanchored,” said Torsten Slok, Chief Economist at Apollo Asset Management. Slok believes that markets are already pricing in this scenario, and that high inflation and the Fed response will continue to weigh on credit and equity markets.

Currently, there’s no clear signal in any of these particular directions. Investors seem to be weighing the mixed data they’re seeing and trying to decide what’s more important: Persistent inflation or an economy strong enough to continue job and wage growth along with healthy corporate earnings.

Watch Your Head – Debt Ceiling

In mid-January, Treasury Secretary Janet Yellen sounded a warning bell, saying that the U.S. federal debt would soon reach its legal limit. She also said that by taking “extraordinary measures”, the true deadline would be delayed until sometime this June or July. The concern is that instead of voting to raise the debt ceiling and enabling the government to make good on its debts, lawmakers could refuse to compromise, which could end with a default by the U.S. Treasury – an unthinkable and damaging outcome.

We are monitoring the situation closely, but at this time we believe there is no reason to panic. Every expert we talk with believes this issue will be resolved without damage to the credit of the U.S. government and the financial markets. As we approach early summer, we’ll be assessing new developments on the debt ceiling and will be vigilant if negotiations aren’t progressing toward a favorable outcome.

From an asset allocation perspective, we remain focused on quality in the equity markets. We believe that attractively priced companies with sustainable competitive advantages in their sectors will be rewarded in the currently volatile market environment.

Income investors can now find yield far easier than during the previous market regime, but they’ll need to monitor Fed activity. Bonds are now attractive investments once again. It is still prudent to remain focused on interest rate sensitivity within bond portfolios.as we navigate short-term uncertainty around future rate hikes by the Federal Reserve.

Whatever the balance of 2023 brings, it remains vitally important to adhere to your long-term financial objectives and invest with the future in mind. A sound financial plan can help investors weather short-term fluctuations on the way to realizing their goals.

As always, don’t hesitate to contact your Cornerstone advisor with any questions or to have a conversation about your financial situation.

The Cornerstone Team

Disclosure: Cornerstone Advisory, LLC, is registered as an investment adviser with the SEC. The firm only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment or strategy will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals, and economic conditions may materially alter the performance of your portfolio.