“Men are not disturbed by things, but by the view which they take of them.”

~ Epictetus (AD 50-135)

Market Roundup

Stoic philosopher Epictetus built his life around discipline and equanimity in the face of many challenges. But even he may have been perturbed by the performance of stocks and bonds this year.

The third quarter brought more weakness in stocks, with a S&P 500 Index decline of more than 15%. In July, the market rose on a fool’s gold rally fueled by the belief that the Fed might slow or even abandon their interest rate hikes to reverse slowing growth in equities earlier than expected.

But the Fed stayed true to its original course in its fight against its nemesis inflation with the third consecutive 75-basis-point rate hike in September, raising the federal funds rate to 3.25%. Inflation has proven to be tenacious, and the Fed is moving at an extraordinary pace from a stimulative to a restrictive monetary policy. Generally, the consensus view appears to be at least a few more hikes of 75 bps, with the hope that early 2023 could bring a slowdown or possible halt to rate increases, as the economy responds to the rate hiking cycle by slowing down and possibly contracting. The Fed’s intent is to regain control of inflation to avoid uncontrolled persistent inflation.

Déjà vu all over again

Many prognosticators are expressing worries that the Fed’s aggressive pace could trigger a deep recession and bring stocks down even further. But an examination of similar previous cycles reveals that their worries may be unfounded.

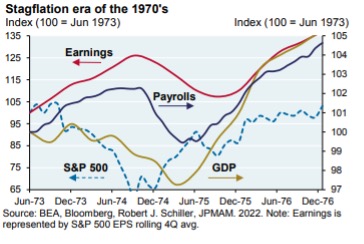

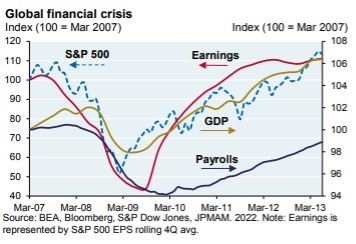

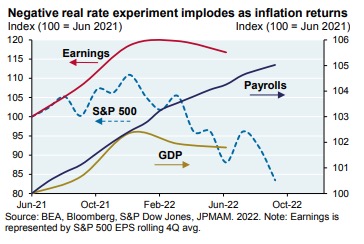

One of the keys to being a successful investor is having a sense of history. As illustrated in the following charts, the drop in equities preceded the fall in earnings, growth, and employment during previous recessions. Think of the stock market as the canary in the coal mine, taking damage before earnings, valuations, housing, trade, and other sectors.

Earnings reports have been relatively weak so far for Q3. If history repeats itself in this cycle, this suggests that the market has been ahead of the economy and corporate earnings by at least 10 to 12 months. As you can see from these visuals, markets tend to recover well before the bottom in economic growth and the earnings cycle. This asynchronous pattern is one of the reasons why attempting to time the markets is so challenging. We believe a better process for investing is to construct diversified portfolios that can withstand these cycles.

Understanding where we are in the cycle – and studying these kinds of historical patterns – helps us put short-term worries into context and ensure that client allocations are best prepared to benefit from what’s coming next.

Now’s the time for future planning

There’s an old Wall Street adage that encourages investors to “buy umbrellas when the sun is shining.” Well, it’s raining right now, which means you may want to consider stocking up on sunglasses.

It may be time to consider increasing the equity allocation of your portfolio to take advantage of favorable pricing before the market begins its recovery. Periodic rebalancing ensures that your long-term allocation stays on target through inevitable market rallies and downturns. We’re taking care of this for you at Cornerstone as the end of the year approaches.

Dollar-cost average for tomorrow

Dollar-cost averaging is just another way of saying you’re making ongoing contributions to your retirement or other investment accounts on a regular basis. This approach takes the emotion out of the equation, since you know how much you’re contributing each period. Automating the process with automatic deposits on payday is the best approach, because you’ll never even notice the money.

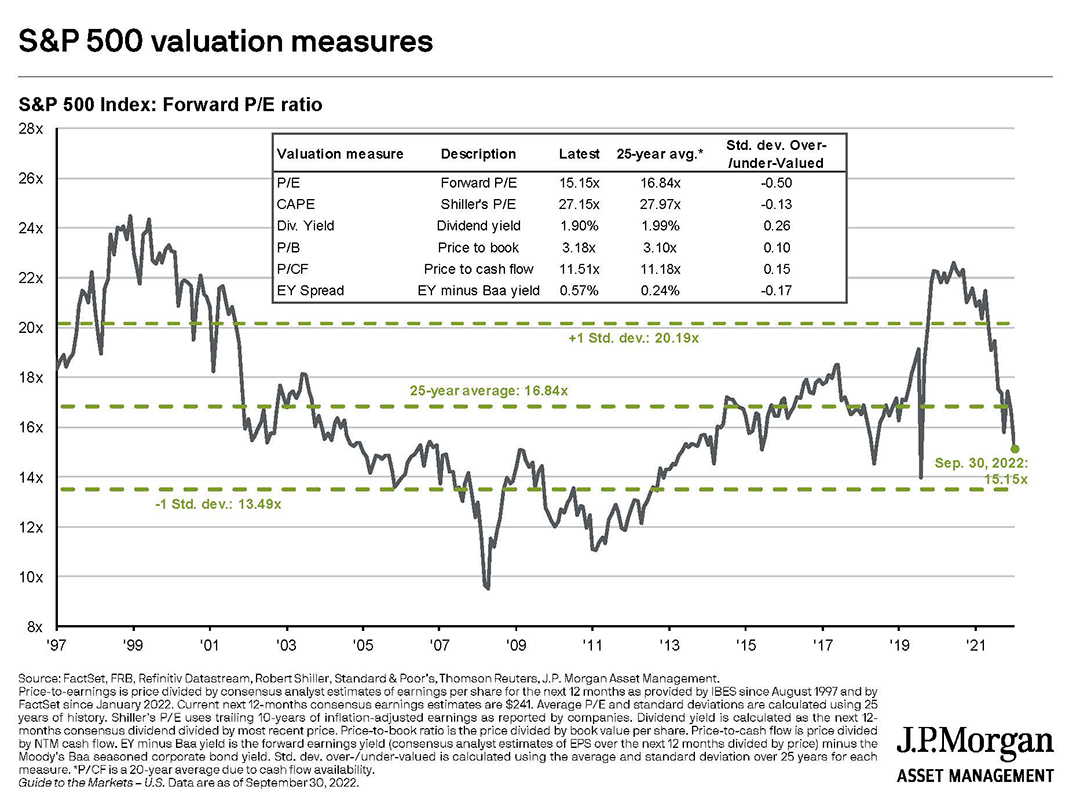

As the chart below shows, forward price/earnings ratios are at 15.15, below their 25-year average of 16.84. When stocks are down, you’re buying them at a discount, so you’re getting more shares with the same amount of money. When the market eventually recovers, you’ve amassed a larger number of shares that are now on the rise. Disciplined, consistent investing like this is how wealth is built over time. Take advantage of cheaper markets today to plant seeds for tomorrow.

A comprehensive approach

Market movements aside, as we move forward through these uncertain times it’s an optimal period for you to ensure that the rest of your financial situation is shored up and secure. Is your emergency fund fully funded? According to the CFP® Board, investors should have three to six months of expenses set aside in cash to take care of unexpected costs or job loss.

If you prefer to have a higher level of liquidity as recession looms, options like U.S. Treasury bonds and money-market funds are yielding more than they have in more than a decade. Putting your cash to work in these vehicles will ensure that your purchasing power isn’t completely eroded as the battle against inflation rages on.

Declines offer tax-savings opportunity

Last year brought substantial market gains, and in 2022 markets have been volatile. But with this downward trend comes opportunity – harvesting your losses to offset capital gains and income in your portfolio.

If an investment in your portfolio is losing money, and you have gains in other investments in your portfolio, you can sell the investment with the loss and use the proceeds to offset some of the taxable gains. There’s no limit on matching losses to gains. If there are no gains, up to $3,000 in losses can be carried forward for use in future years. Then you can reinvest the cash from the sale into a different security that fits into your overall allocation.

The benefits of tax-loss harvesting could be substantial in your taxable accounts. Current market conditions make this an ideal time to evaluate your portfolio for losses that could be used to offset gains this year and beyond. Some investments, particularly mutual funds, could have a taxable distribution this year, despite negative performance, making tax planning even more important. Your Cornerstone advisor is working to ensure these opportunities are maximized in your portfolio.

You don’t need the implacable stoicism of Epictetus to successfully navigate an equity market in flux, just a diversified portfolio and a long-term financial plan designed to help you succeed through up and down markets. Talk with your advisor about what lies ahead and how you can put yourself in a position of strength in the face of market weakness.

As always, if you have any questions or would like to have a conversation, please reach out to us or your portfolio manager.

The Cornerstone Team

Disclosure: Cornerstone Advisory, LLC, is registered as an investment adviser with the SEC. The firm only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment or strategy will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals, and economic conditions may materially alter the performance of your portfolio.