The Inflation Debate

It’s the most dangerous drinking game on Wall Street – every time you hear the word “transitory” to describe inflation, tip your glass. In April, Jerome Powell, chair of the Federal Reserve, used the word himself to describe inflation as being a temporary issue that isn’t poised for a sustained or steep rise. So far, investors have been drinking from the same punch bowl, pushing major market indices to record levels. As of June 30th, the S&P 500 Index had risen more than 14%, and the Dow and Nasdaq had gained just over 12% year-to-date.

What supports the case for transient inflation? The rise we’re seeing now is due in large part to the economic reopening as the coronavirus pandemic begins to ebb in the US. The release of pent-up demand, combined with a massive amount of discretionary cash from multiple stimulus packages, is flooding the economy and powering an economic resurgence. Companies are scrambling to reactivate their supply chains and labor is in short supply. Prices on everything from used cars to home appliances are rising, causing alarm among consumers who are making larger purchases earlier than they planned, fearing future price increases. Powell acknowledged the pricing surge in June while pledging not to raise rates based on inflation alone.

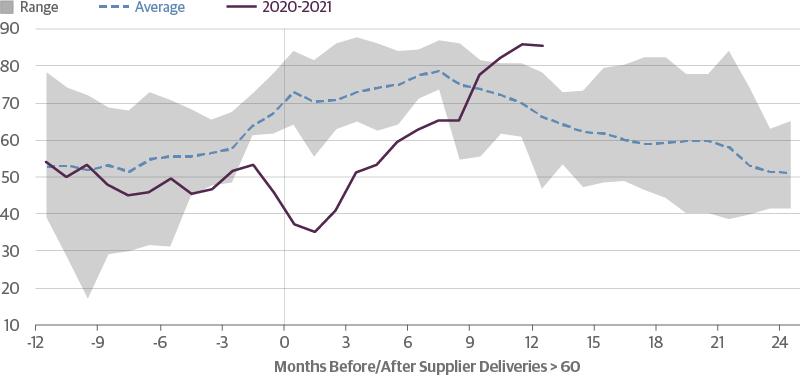

We believe these forces – and the concerns that surround them – are legitimate, however the economic reopening won’t last forever. As demand normalizes and supply chains return to peak capacity, prices on consumer goods should begin to drop. The chart below illustrates how supply disruptions have historically caused manufacturing prices to rise in the months after the disruption, and how they normalize over time.

History Shows Manufacturing Supply Chain Pressures Will Ease

ISM Manufacturing Prices (Diffusion Index) Around Supply Disruptions (1980 – Present)

Source: Guggenheim Investments, Haver Analytics. Data as of 3.31.2021. Supply disruptions are defined as ISM Manufacturing Supplier Deliveries Subindex rising above 60. Seven historical episodes are covered by the range and average.

There are also many long-term deflationary forces at work that aren’t garnering the same headlines as inflation. These include a low global birth rate, the rise of technological innovation, and globalization.

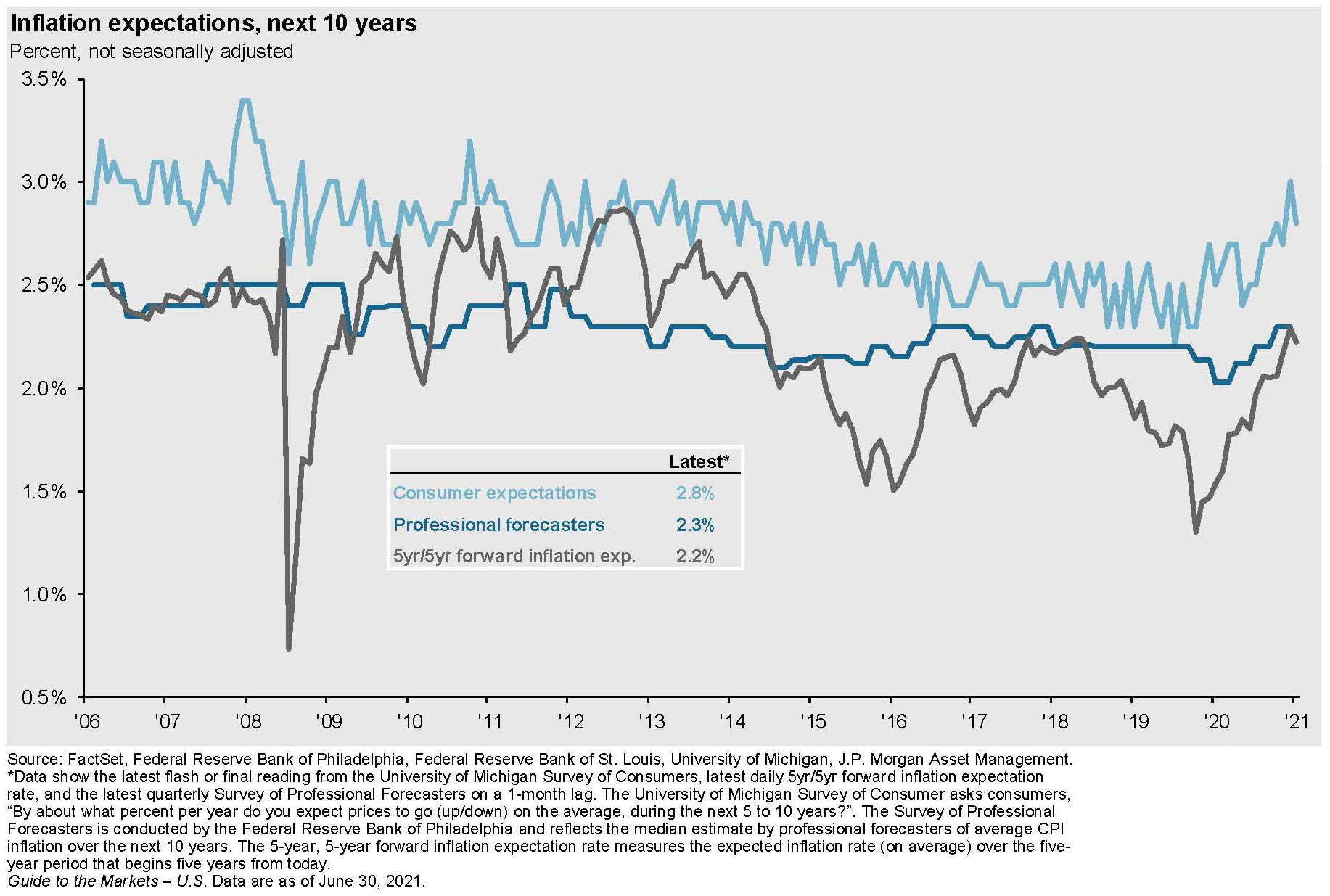

In the meantime, Wall Street consensus has shifted from a strictly “transitory” (drink) inflation problem to a “stickier” version, which could take approximately a year to ebb. Central bank officials are now predicting an inflation rate at about 3%, outside of food and energy prices. The chart below illustrates the view that consumers as well as professional forecasters expect inflation to remain in the 2-3% range, which is our base case.

We acknowledge that there is a real risk that the Fed could be mistaken and be forced to act aggressively to tamp down inflation expectations. That would most likely result in sharply higher interest rates and lower equity prices. For long term investors, which is who we are, this would present an opportunity.

If you’re concerned about inflation, consult with the team here at Cornerstone Advisory to ensure that you have a financial plan designed for the long-term, so you’re prepared no matter what the market brings in the short term. There are ways to position your portfolio to safeguard against the volatility inflation can create. For example, real assets that are less or lowly correlated with the stock market – including things like timber, farmland, infrastructure, or real estate – can act as a stabilizing force in your portfolio if other asset classes exhibit inflation sensitivity. We offer access to these and other types of investments that provide shelter from the inflation storm – however long it lasts.

Rotations Beneath the Surface

2020 was the year of the stay-at-home economy. Consumers relied heavily on technology companies built to flourish in a remote environment. Technology names like Amazon, Shopify, Zoom, Etsy, and others rose dramatically as investors anticipated an increased use of online shopping and services. Large-cap growth stocks outperformed their value counterparts by a measure not seen since the dot-com bubble in 1999.

During the first quarter of 2021, that dynamic reversed as COVID vaccinations spread and the reopening trade took hold. Companies with depressed valuations, often in sectors hit hardest by the pandemic, began to recover. As the second quarter progressed, value and growth ran more evenly.

So where does an investor go from here? Cast a wide net to maximize your opportunity set and ensure you’re not missing out on potential gains. We may not be in the very beginning of the recovery, but we believe there is still room to run, based on a strong economy and excess cash that has yet to enter the market and the economy itself. Make sure you’re prepared for rising interest rates, as the Fed has signaled that a rate rise is imminent in the year ahead. If you have questions about how to do that, please reach out to your Portfolio Manager.

Avoid the Crowds and Plan Ahead

The surge in demand for certain products and services as the economy reopens offers a lesson in the importance of knowing when to go against the crowd. For example, despite low interest rates, this has become an extraordinarily challenging time to buy or build a home. That’s because the pandemic confined many of us to our homes for an extended period, and many thought it was time for a change of scenery or renovation. This demand combined with limited inventory has led to unprecedented levels of price growth. And if you’re hoping to build a new home, the costs for building materials have soared due to aforementioned supply chain constraints.

Similarly, a spike in travel demand has driven prices for airfare, car rentals, and hotels high. According to the U.S. Labor Department, airfares rose 10.2% in April over the prior month, a new record. Many car rental companies sold off portions of their fleets during the pandemic, and now find themselves unable to meet the demand rebound.

Financier and railroad executive Russell Sage once said, “Buy straw hats in the winter when no one wants them, and sell them in the summer, when everyone needs them.” Now is a good time to consider the value of the contrarian view, an approach that works as well in investing as it does when deciding where to take your next vacation. Following the crowds is a good way to find yourself buying high and selling low.

Establishing and following a long-term, customized financial plan is an effective way to resist the siren song of the crowd. If you have any questions or concerns, please reach out to us or your advisor.

The Cornerstone Team

Disclosure: Cornerstone Advisory, LLC, is registered as an investment adviser with the SEC. The firm only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment or strategy will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals, and economic conditions may materially alter the performance of your portfolio.