“The best lack all conviction, while the worst are full of passionate intensity”

– William Butler Yeats, The Second Coming

The absence of an economic recession in the U.S. economy in 2023 was a surprise to numerous market commentators. Wall Street celebrities like Jamie Dimon, Ray Dalio, Stanley Druckenmiller, Leon Cooperman, and Jeremy Grantham had all publicly predicted a recession that never materialized. In their defense, all predictions are tough unless you are an astronomer predicting the next solar eclipse, and it’s worth noting that all the above mentioned made their career by preparing for the future and executing their process.

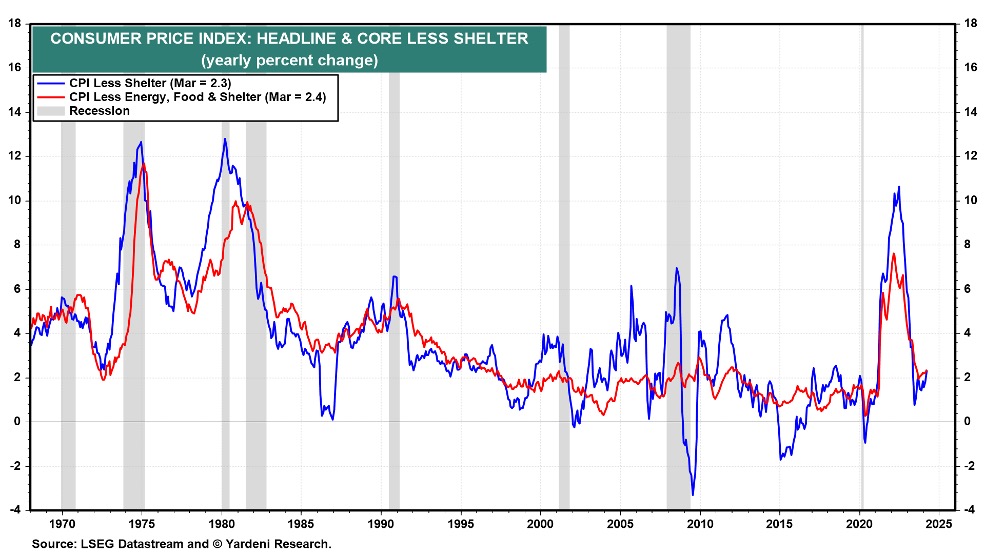

With spring upon us in 2024, it is safe to say that the doomsayers last year got it wrong. Remarkably, GDP has exceeded expectations, while the unemployment rate has remained historically low for the last two years. Concurrently, inflation continues to trend lower (chart below). This is an economic backdrop that few predicted last year and is exactly why having a process for investment and sticking to your principles can make all the difference in long-term results.

Simultaneously U.S. corporate earnings continue to grow driving the stock market back up to all-time highs and erasing the losses experienced in 2022 (chart below).

As often happens, the price of stocks has been rising faster relative to their collective earnings, which is a fancy way to suggest that stock prices are elevated at current levels. Q1 earnings season is right around the corner and will likely be the next big catalyst for the stock market. Hopefully, earnings and corporate guidance for the coming quarters will exceed expectations and this bull trend can continue. If something else happens, remember that part of your investment plan is to be diversified.

The bond market is offering investors an opportunity they have not had since early in this century. Current bond yields are at or near ~5% with room for the Federal Reserve to cut rates if inflation continues to fall or if economic expectations take a negative turn from where they are today. Either situation would give the Federal Reserve room to cut interest rates, which would be good for some stocks but all bonds. I.e. The Fed-Put is back.

Last year was an excellent reminder that economic forecasting is an exceedingly difficult business and being an accurate forecaster is not a requirement for success. Having a clear process and the discipline to follow that process day-in and day-out is what ultimately leads to positive outcomes.

As tax season comes to a close, it’s a good time of year to take stock of all your financial fundamentals. Assets, Liabilities, Cashflow. If you are ready to work on your plan, give us a call. We look forward to hearing from you.

As always, don’t hesitate to contact your Cornerstone advisor with any questions or to have a conversation about your financial situation.

The Cornerstone Team

Disclosure: Cornerstone Advisory, LLC, is registered as an investment adviser with the SEC. The firm only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment or strategy will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals, and economic conditions may materially alter the performance of your portfolio.