COVID and political uncertainty – What else is new?

More than 18 months into the pandemic, the coronavirus remains a force to be reckoned with. The Delta variant has reignited the coals of the disease’s spread, just when it seemed to be declining in the spring. Total cases and hospitalization rates rose during the summer, triggering the return of social distancing, masking, and travel restrictions. Large companies responded by issuing vaccine mandates.

As we entered autumn, threats in the form of political gridlock began to appear. In early October, lawmakers came to a temporary agreement to avoid a potentially damaging default on U.S. debt due to the debt ceiling being reached. The agreement puts the partisan battle on hold, with drama potentially returning at the new deadline in December.

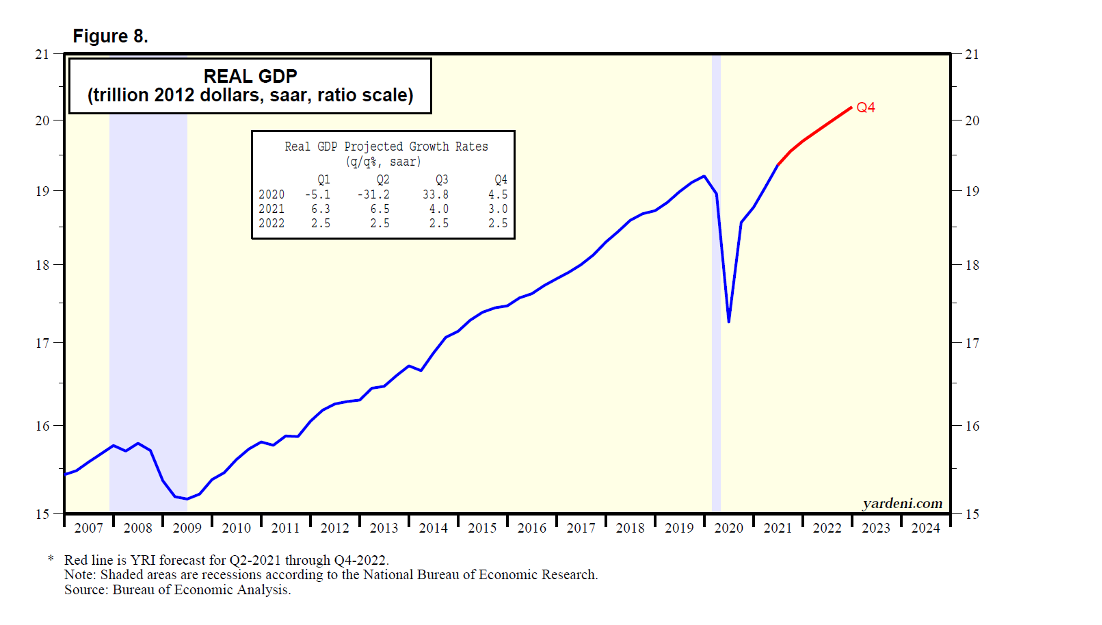

September held true to its reputation as a weak month for market returns, with the S&P 500 Index down 4.8%. But despite this unsettled backdrop, economic growth continues to grind upward. As seen in the chart below, Q2 real GDP rose to a level not seen since before the pandemic, and this growth is forecast to continue into Q4 and beyond.

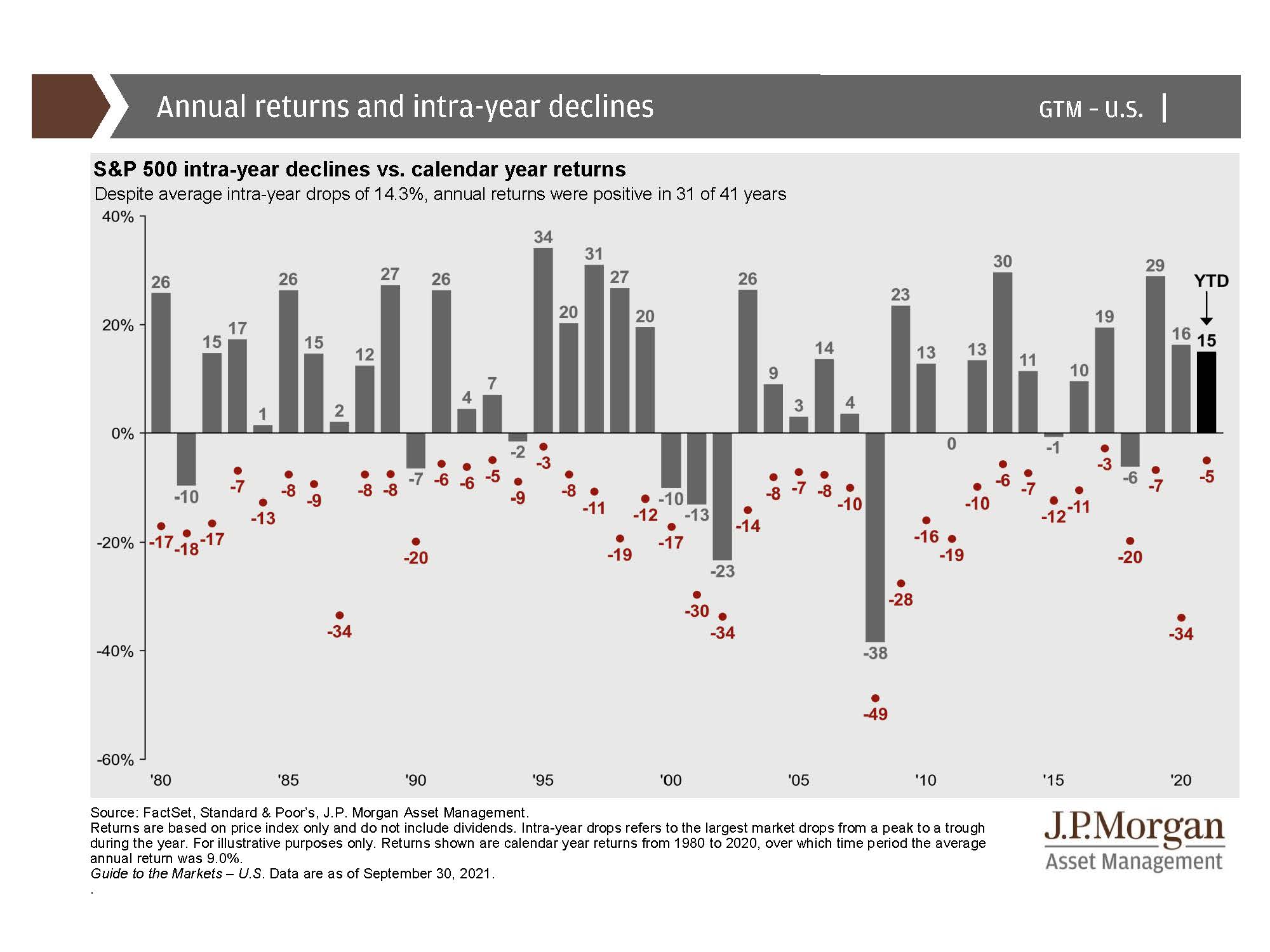

What to make of this clouded picture? When interpreting the mixed signals of a market pullback and steady economic growth, it’s helpful to look at comparable past markets for a sense of perspective. The chart below shows how, despite average intra-year declines of 14.3% since 1980, annual returns were positive in 31 of 41 years.

Does GDP growth always equal a strong stock market? Certainly not. But it’s rarely a good idea to bet against the strength of the U.S. economy, particularly during a durable recovery like the one we’re seeing now.

Inflation sticks around

The continuing debate around inflation centers around its staying power. Earlier this year, Fed Chairman Jerome Powell stated that he believed inflation would be transitory in nature. In congressional testimony at the end of September, Powell admitted that inflation had proven more durable than he had initially suggested: “As the economy continues to reopen and spending rebounds, we are seeing upward pressure on prices, particularly due to supply bottlenecks in some sectors. These effects have been larger and longer lasting than anticipated.”

It’s important to remember that we’ve only been talking about inflation as a concern for about six months. Inflation could persist deep into 2022, and our wallets would certainly feel the impact. But we don’t think we’re in for a repeat of sustained 1970s-style price increases in the months ahead.

In the meantime, we are closely monitoring inflation and its impact on the equity market. The good news is that the fundamental data underlying the market remains strong. Forward earnings – an estimate of the next period’s earnings for a company – reached a new record at the end of September. If inflation surges, we have many tools to deploy in client portfolios that are designed to protect against the impact of inflation. Some of these include private real estate and real assets (including farmland, timberland, and infrastructure), some of which have inflation escalators built into the lease agreements.

What to make of China?

After a decade of growth spearheaded by a robust technology sector, China may be feeling less hospitable for equity investors. A series of aggressive regulatory moves by President Xi Jinping sent Chinese tech stocks sliding and spooked overseas investors who lamented the lack of clarity around the measures.

Shortly thereafter, the Evergrande group, China’s second-largest property developer, revealed that it was in danger of defaulting on its debt. Some have speculated that the company is large enough that its potential collapse could turn into a “Lehman moment” for China, and lead to other problems in the Chinese real estate sector, which accounts for about 30% of Chinese GDP.

When evaluating a given market, it’s important to look at the total picture. In a recent podcast, Gabriela Santos, Global Market Strategist at JPMorgan Asset Management, examined China’s long-term growth prospects considering these recent challenges. “For Chinese markets, it’s never about the economic cycle,” Santos said. “It’s more about the long-term trends, related reforms, and regulatory pushes. The next stage of development is less about quantity, and more about quality of growth.”

China’s leaders are aware of its declining birth rate and shrinking labor force. “That’s why China is so focused on innovation as a future driver of growth. China is really focused on supporting hard tech – things like 5G technology, artificial intelligence, semiconductors, quantum computing, and cloud software. That’s what they really see as their road to prosperity.”

Looking ahead

In the months ahead, there will be no shortage of market threats for investors to evaluate. Political gridlock isn’t showing any signs of letup, the Federal Reserve is set to begin tapering its quantitative easing program, and global energy prices are on the rise, to name a few.

Our outlook on equities remains constructive, even as we recognize that new challenges continually emerge for the markets and the economy at large. That’s why we consistently focus on our investment process to ensure that we follow our discipline and live up to our investing and planning principles throughout the market and economic cycles.

Financial theorist William J. Bernstein once said, “investment success accrues not so much to the brilliant as to the disciplined.” Now more than ever, it’s important to maintain a long-term view when it comes to your portfolio. Holding fast to a disciplined approach is made easier with an investment approach that reflects your individual goals and risk tolerance, along with a customized financial plan to keep you on track no matter which way market winds blow.

As always, if you have any questions or would like to have a conversation, please reach out to us or your portfolio manager.

The Cornerstone Team

Disclosure: Cornerstone Advisory, LLC, is registered as an investment adviser with the SEC. The firm only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment or strategy will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals, and economic conditions may materially alter the performance of your portfolio.