In the 1930s radio drama “The Shadow”, the narrator uttered the famous introduction “Who knows what evil lurks in the hearts of men? The Shadow knows!”

Too bad the Shadow couldn’t have clued us in to Vladimir Putin’s plans for Ukraine. The human cost of the Russian invasion is already tragic, and an affront to those who value peace and democracy around the world.

Putin has succeeded in isolating himself and his country, but little else. At the time of this writing, the invasion has faced stiff resistance from Ukrainian defenders and strong leadership from President Volodymyr Zelensky. Heavy sanctions from the international community have severely hobbled the Russian economy, and there are signs that Putin may be beginning to lose his iron grip on the hearts and minds of the Russian people. His end game remains unclear, but for now no peaceful resolution is materializing.

What is certain is that the self-inflicted economic damage to Russia is deep. The country is being removed from global equity indices and the ETFs linked to them. Even Jim O’Neill, former chairman of Goldman Sachs and coiner of the emerging markets basket acronym BRICs (Brazil, Russia, India, and China) recently yanked Russia from the list he created.

Rising interest rates

The Federal Reserve has started raising interest rates with a 0.25% increase announced during its March 16th meeting. The Fed also signaled that there will be more further hikes at all six remaining meetings this year. Fed Chair Jerome Powell is determined to tamp down inflation, after last year when he described it as transitory in nature because of the pandemic.

But what was once a straightforward inflation scenario of disrupted supply chains has now been complicated by persistent supply chain disruptions, an unexpected labor shortage, and Putin’s machinations in Ukraine. Inflation relief from a waning pandemic could be delayed further, and we’re already seeing rising gas prices as summer approaches. Russia is one of the world’s largest wheat producers, and prices for the commodity have soared since the start of the conflict. This increase will be felt in the form of rising food prices for consumers worldwide. This is only one example of commodity scarcity causing a ripple effect throughout the global economy that leads to higher prices.

We won’t know where inflation is headed long-term until late 2022 or even into 2023. But even if inflation is worse than most believe now, we still believe that in 24-to-36 months inflation will indeed have moderated significantly.

Mixed outlook on equities

The equity market has gotten off to a volatile start for the year. Markets entered correction territory in late February and have been trading within a narrow range since then. We view this as a healthy development for what was an overheated equity market.

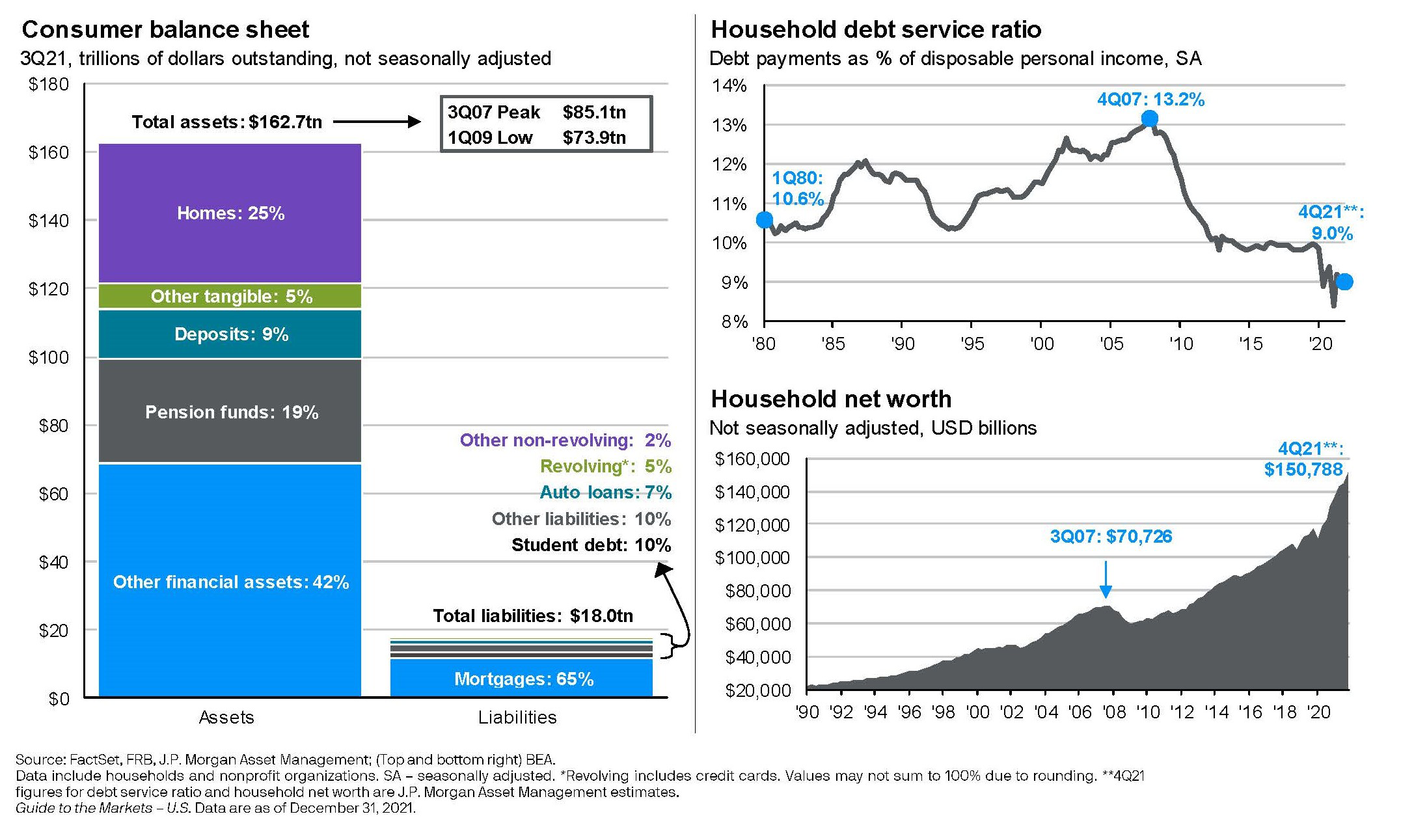

There are positive tailwinds for the global economy that are being drowned out by the conflict in Ukraine. Corporate profitability is at historic levels. There are $3 trillion dollars of capital on corporate balance sheets that weren’t there pre-pandemic and the American consumer remains quite healthy from a financial perspective, as demonstrated by the graphic below.

Consumer finances

The pandemic seems to be dissipating, and global consumers are sick of social distancing and staying home. That pent-up demand, especially in the United States, will find its way into the economy and create momentum from here in our opinion. The rest of the world may be more challenged as Europe is facing even steeper energy price increases than we are seeing here, and China’s growth has slowed considerably as it attempts to correct a bubble in real estate.

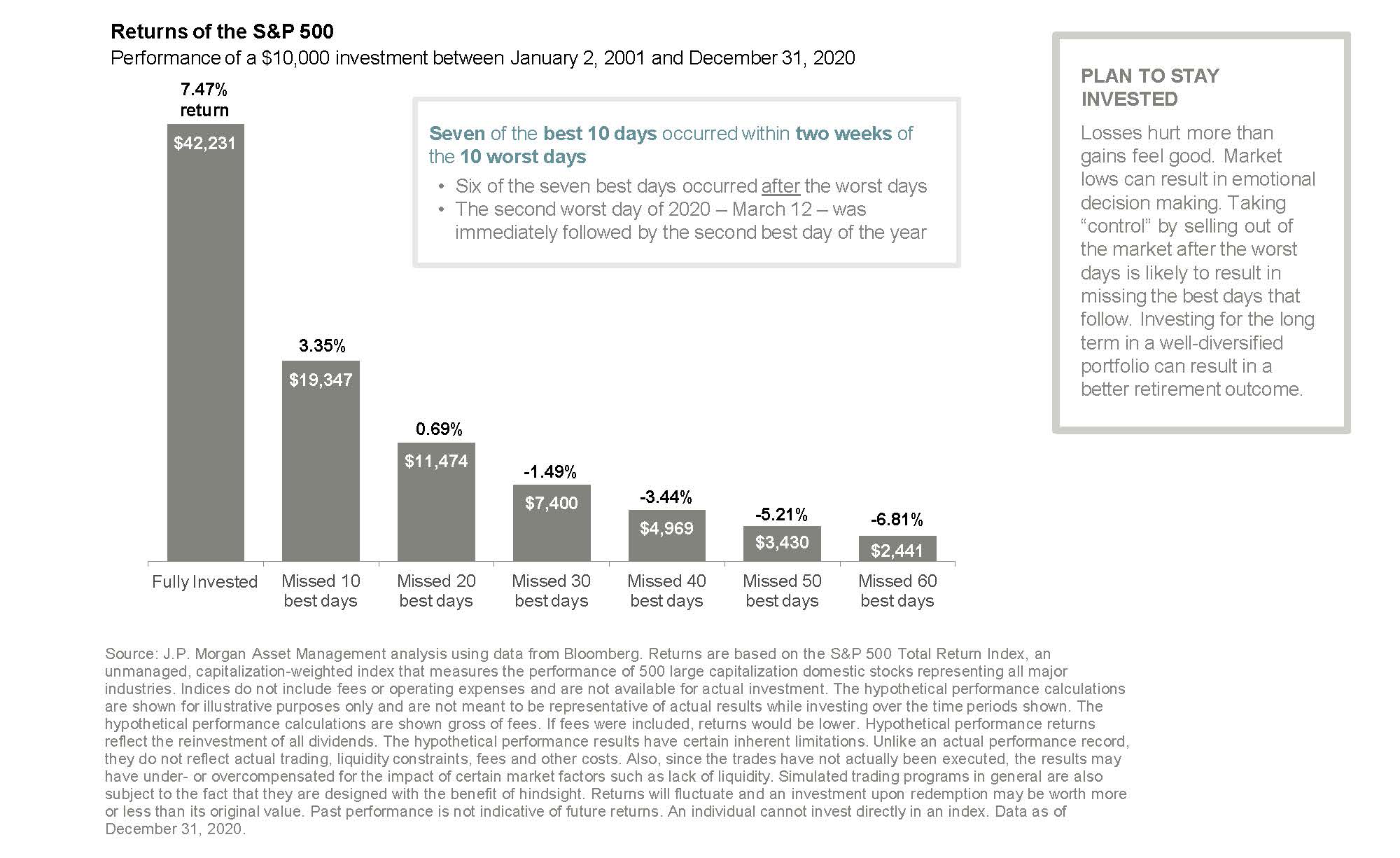

The tension between positive and negative forces could lead to a turbulent year for the stock market and could tempt investors into ill-advised moves like panic selling or trying to time the market – a proposition that almost never works in their favor, as the image below shows.

Impact of being out of the market

Consider the alternatives

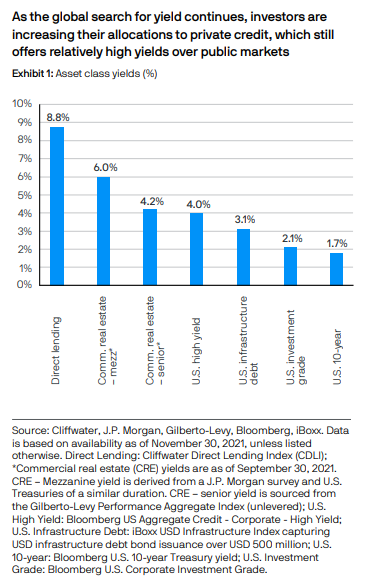

Factors including slowing economic growth, the unpredictability of public health, and the impact of higher inflation mean that equities may have less room to run than in recent years. The Wall Street Journal recently said that “forward-looking nominal annual returns for U.S. equities over the next 10 years are likely to be between 2% and 4%, with inflation predicted to come in at 1.5% to 2.5%.” We don’t view this prediction as the unavoidable destiny of the equity market, but we do concede that the past ten years of equity performance may not look like the next ten.

Meanwhile, fixed income is facing its own challenges. In a rising interest rate environment, bond prices drop, leaving bondholders with negative returns. Fixed-income investors with longer time horizons can benefit from reinvesting their coupon payments at higher rates, but they’re still trying to outrun short-term losses.

The growth of alternative investments shows that more and more investors are looking beyond the traditional 60/40 portfolio. Depending upon your needs, these options can provide income, return, and diversification, since they do not move at the same time or in the same direction as the equity and fixed income markets. These options include private equity, private real estate, private credit, and real assets.

We believe alternative investments can serve a critical role in a diversified portfolio. That’s why we partner with a wide range of expert managers in this asset class to provide you with the best possible options. No matter what comes next for markets, the most effective defense against the unknown is a time-tested investment process and comprehensive financial plan. Adhering to your plan frees you from the stress of the day-to-day headlines that seem to never stop coming.

As always, if you have any questions or would like to have a conversation, please reach out to us or your portfolio manager.

The Cornerstone Team

Disclosure: Cornerstone Advisory, LLC, is registered as an investment adviser with the SEC. The firm only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment or strategy will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals, and economic conditions may materially alter the performance of your portfolio.