Inflation intensification

Like a guest who stays too long at a holiday gathering, inflation proved tough to get rid of in 2021.

During the 12 months preceding November, consumer prices increased 6.8%, according to the Bureau of Labor Statistics. That’s the fastest rate since 1982.

While we recognize that inflation is real and could continue for a time, many of the price increases reflect a bounce back from abnormally low levels during the early days of the pandemic. Consumers have been keeping prices high as they burn through excess cash from the pandemic stimulus, but prices should normalize as cash reserves and spending decline. Supply-chain disruptions, while frustrating now, should be worked out over time. Indeed, we’re seeing signs that production is catching up with demand – think of the surfeit of hand sanitizer in your local grocery store.

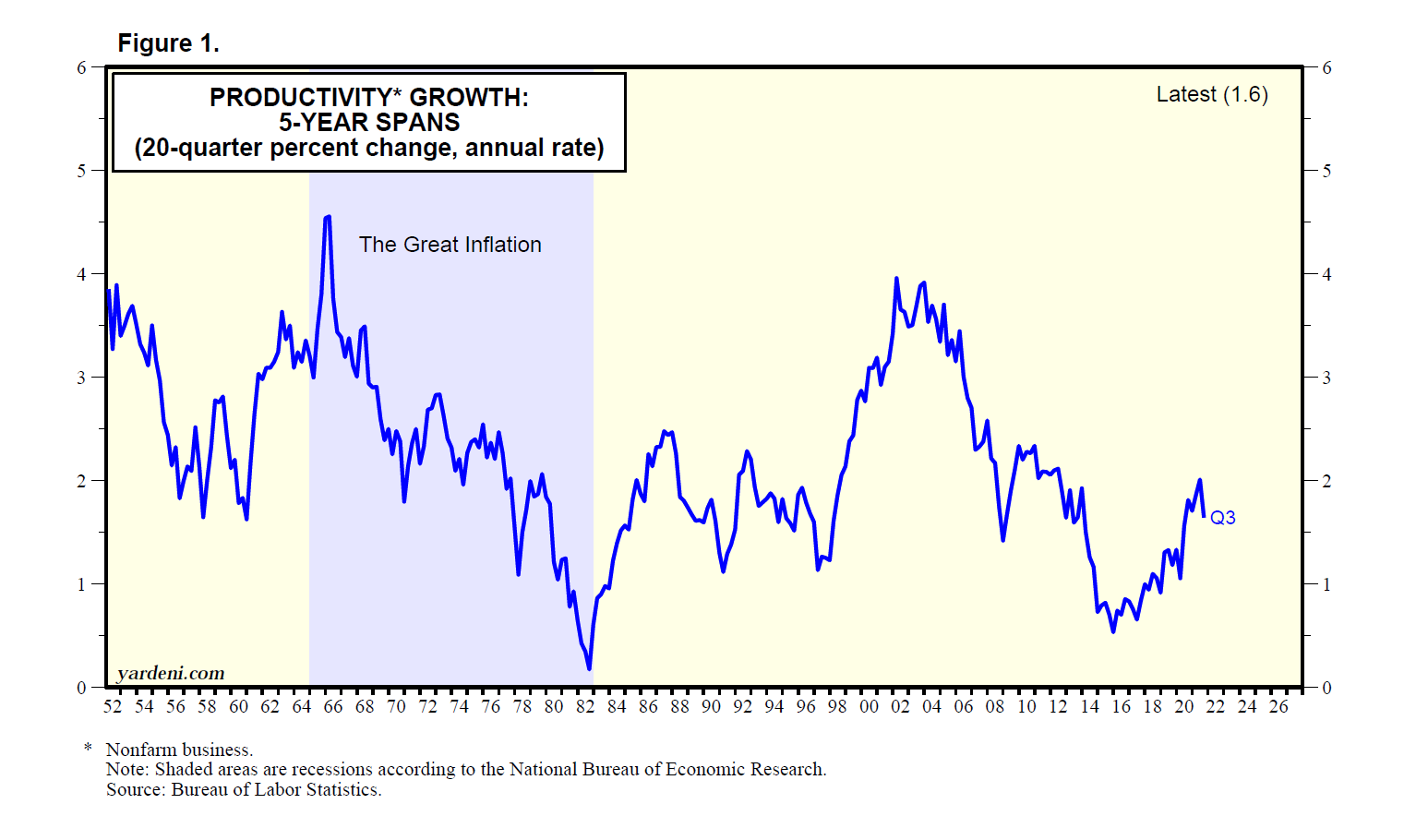

We believe that comparisons to 1970s-era inflation are akin to comparing apples to oranges. As the image below shows, productivity during the “Great Inflation” dropped steadily, but has headed upward during the bulk of the pandemic period. This is due, in part, to a labor shortage – if there are fewer qualified workers available, companies are forced to innovate and do more with less.

As always, there are risks that could give inflation more staying power. Among them is the new Omicron variant of COVID-19. Federal Reserve Chairman Jerome Powell has warned that “greater concerns about the virus could reduce people’s willingness to work in person, which would slow progress in the labor market and intensify supply-chain disruptions.” As we enter 2022, the economic risk from the new variant of COVID-19 will be better understood.

Amid rising rates, attention must be paid

Despite these concerns, the market has ground steadily higher much of this year, for a total of more than 27% as of December 31st.

The U.S. Federal Reserve plans to end its asset-purchase program by March and will begin raising interest rates next spring, a significant pivot from its position earlier this year when many experts didn’t predict rate hikes until 2023. Central bank officials are projecting at least three quarter-percentage-point increases in 2022.

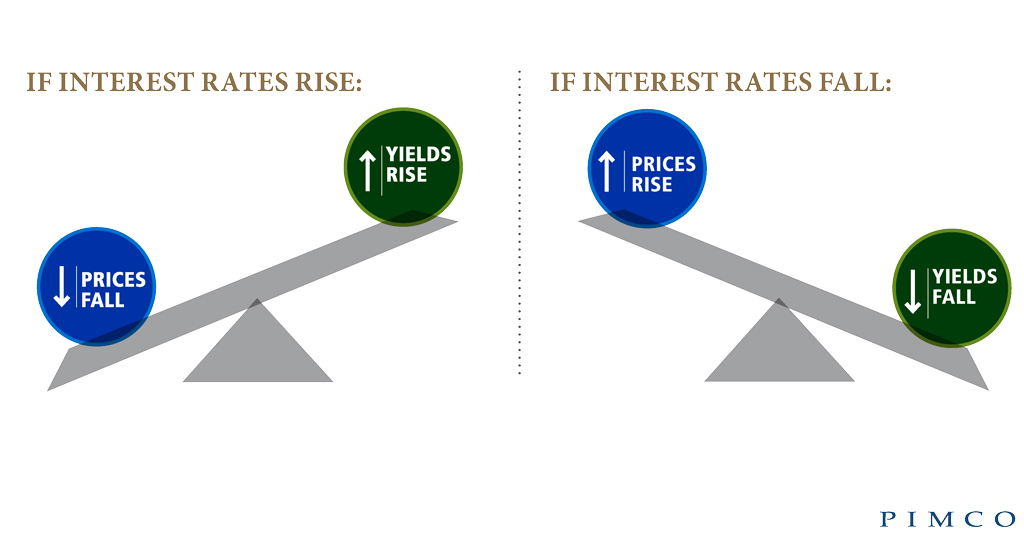

So, what happens in a rising rate environment? The cost of credit goes up, and the spending rate goes down, thereby cooling off the economy and reducing inflation. As illustrated by the image below, rising rates hurt bond investors because of the inverse relationship between interest rates and bond prices: As rates rise, bond prices drop. And the longer the maturity of the bond, the harder it will be hit by a rate increase.

Equities can also be challenged, because in a rising rate environment, spending drops due to increased borrowing costs for consumers and companies, impacting growth rates.

This all sounds tidy in theory, but markets have a way of reacting in unexpected ways. To paraphrase playwright Arthur Miller, “attention must be paid’ in a rising rate environment, which could look different from what we’ve seen over the past several years. Investors seeking income may need to look to other asset classes including real assets, real estate, and other types of alternative assets.

A note on discipline

Former Navy Seal, author, and podcaster Jocko Willink is fond of saying “discipline equals freedom.” His thesis is that by imposing mental and physical constraints upon oneself, one can achieve freedom from obstacles and move more steadily toward achieving their goals. For example, if you want more free time, your best course of action is to implement a disciplined time management system. We would all be well-served by applying this philosophy to your investments in the years ahead.

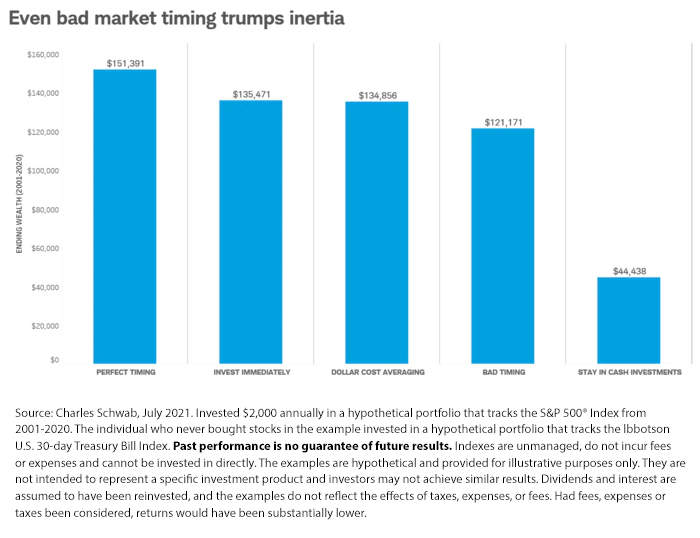

Without a disciplined approach, investors will likely fall victim to the temptation to try to time the market, or even get out of the market altogether. A recent study by Charles Schwab shows the deleterious impact of trying to find the perfect time to invest, instead of putting assets into the market immediately. The study examined five different approaches to putting cash to work. The first was a hypothetical “perfect timer” – something we all know is impossible. The rest are approaches that anyone can take in the real world, including investing immediately, using dollar-cost averaging (spreading periodic investments of set amounts over time), bad market timing, and staying out of the market in favor of cash.

In the study, each investor received $2,000 at the start of each month for 20 years, ending in 2020. The investor who simply put their cash into the market immediately won out over the other real-world options. That’s because it’s impossible to identify market tops or bottoms consistently over time and sitting on the sidelines is a surefire way to underperform over time.

Naturally, investors shouldn’t be overly allocated to equities if that clashes with their long-term financial plan and time horizon. But the best way to defeat market anxiety is to get and stay invested for the long haul, in accordance with a comprehensive financial plan aligned to your individual goals.

As always, if you have any questions or would like to have a conversation, please reach out to us or your portfolio manager.

The Cornerstone Team

Disclosure: Cornerstone Advisory, LLC, is registered as an investment adviser with the SEC. The firm only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment or strategy will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals, and economic conditions may materially alter the performance of your portfolio.