Historic Multifarious Crises

2020 was an historic year. The United States and the world faced four substantial crises simultaneously. We began the year in a political crisis with a divided government, citizenry, and a President in the process of being impeached by Congress. Within weeks the world was engulfed in a major global pandemic, which triggered a sudden stop of the global economy causing a financial market panic and economic calamity. During the 2020 spring and summer in the United States, we faced civil unrest to a degree not seen since the race riots of 1968. All these crises were in some way linked and we were all affected by them. The fact that all these events happened within the same year will likely have lasting implications that we can only guess at today.

As winter comes to an end, it appears that the most challenging period of the pandemic is behind us. At Cornerstone Advisory, our sincerest sympathies go out to those most profoundly affected by the events of the last year. As the signs of spring emerge, we see a horizon filled with opportunity and a strong economic backdrop for a continued recovery.

Disaster Response

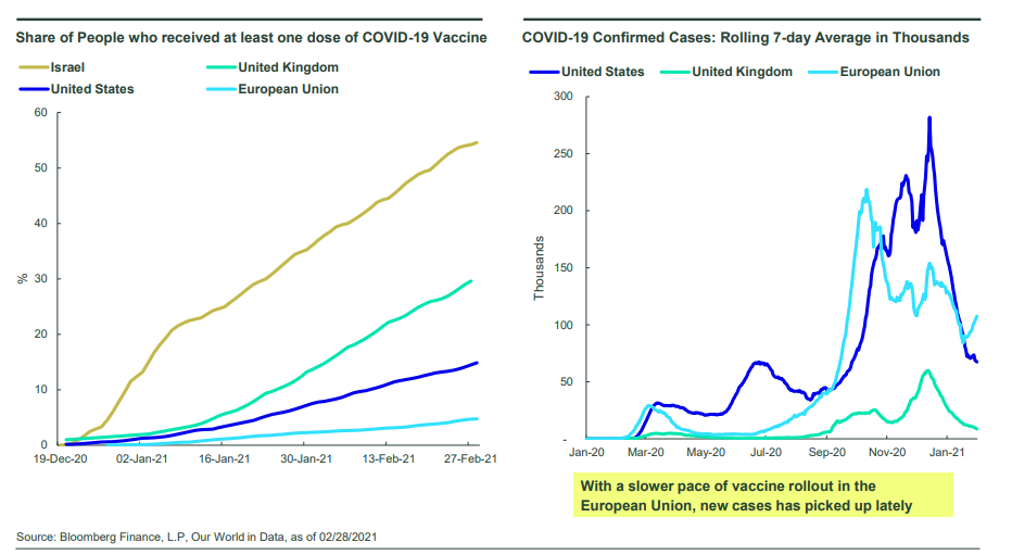

Public policy defined how each country across the globe has responded to COVID-19 and that has implications for how the global economic recovery will unfold in the quarters and likely years to come. This has echoes of the strong government support from the U.S. government to the Great Financial Crisis of 2008/9 vs. the attempted austerity response from the EU.

As the above chart illustrates, Europe has struggled to organize and execute a cohesive vaccination program, while the U.S., after a challenging start, has clearly accelerated the effort in recent weeks. These trends have economic implications for investment not to mention the social impacts.

Emerging markets, especially in Asia, have been an area of opportunity for us over the last year. Their higher rates of economic growth translated into improved investment performance throughout the region. As we have previously mentioned, leaning into actively managed strategies has been accretive to our investment performance since the start of the pandemic. This has been true in the international part of our portfolios.

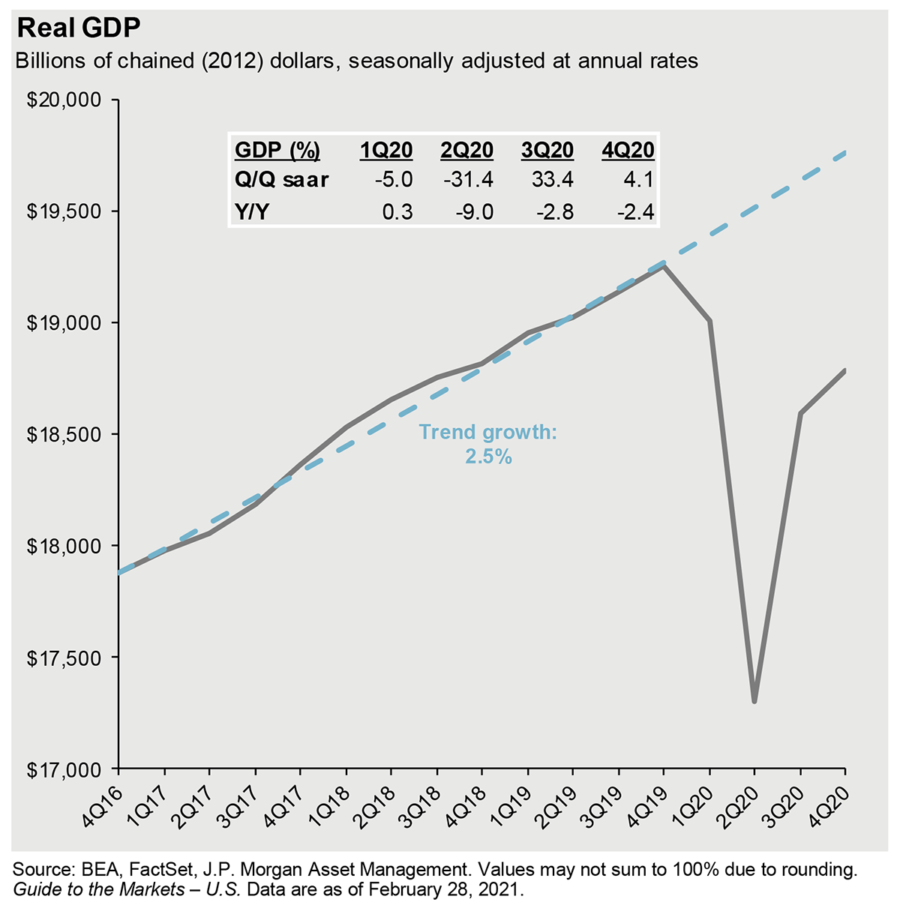

Government stimulus in the U.S. was enormous, swift, and continues to be a driving force in our economy. Last March, government action restored investor confidence enough to stimulate a significant recovery in financial markets as well as much of our economy. This continues today and seems set to accelerate. We have likely witnessed one of the swiftest economic recoveries in history.

While much progress has been made, the U.S. economy will take some time to return to trend growth. The below chart illustrates the progress that has been made in terms of real GDP and the existing gap between current GDP and trend growth. From an economic perspective, pent up demand due to quarantining and social distancing combined with significant economic stimulus will likely drive historic rates of growth for the remainder of this year and likely into 2022.

Benefitting from a Strong Core

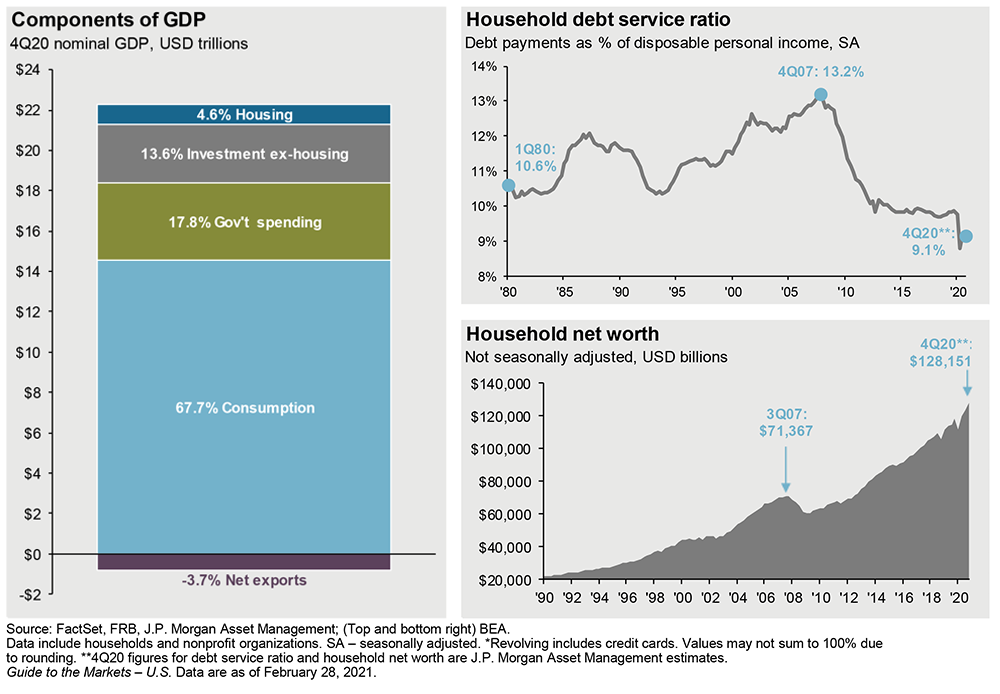

US GDP is driven by consumer spending. The second largest contributing factor to GDP is Government spending, as you can see from the below chart on the left. Both are set to contribute to strong GDP growth for some time to come.

The health of the American consumer is extraordinarily good. The charts above illustrate that household net worth is at all-time highs while household debt to income ratios have been pushed down to multi decade lows. The former is the continuation of a long-term trend and the latter is likely due to recent government stimulus.

Additionally, the current boom in the housing market should provide sustainable economic activity as new home buyers furnish and update their new homes. As restaurant, travel, and leisure employees go back to work or increase their working hours in 2021 the positive momentum should build on itself here and around the world.

The above average performance of the stock market over the last year occurred in the face of so much underlying adversity across the globe. Investors ignored the current reality and focused on the positive effects of government stimulus and hopes for a positive outcome for COVID-19 vaccine development.

Going forward investors will be forced to begin assessing the underlying economic and financial realities across the investment landscape. That comes with uncertainty, which will likely lead to an increased level of market volatility in the short term.

We have already seen this process begin to play out as the Nasdaq 100 index recently fell by ~11% between mid-February and the first week of march.

Throughout 2021 it will be important, as it always is, to maintain a long-term perspective as the macroeconomic backdrop is currently quite strong and will likely remain so for some time.

If you have any questions or would like to have a conversation, please reach out to us or your portfolio manager.

The Cornerstone Team

Disclosure: Cornerstone Advisory, LLC, is registered as an investment adviser with the SEC. The firm only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment or strategy will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals, and economic conditions may materially alter the performance of your portfolio.