As you’re likely aware, the Russian invasion of Ukraine has begun. While we don’t claim to know more than the experts on the ground, we thought it would be helpful to provide some historical perspective on comparable events in the past and the impact they had on markets.

Market Outcomes Can Be Counterintuitive

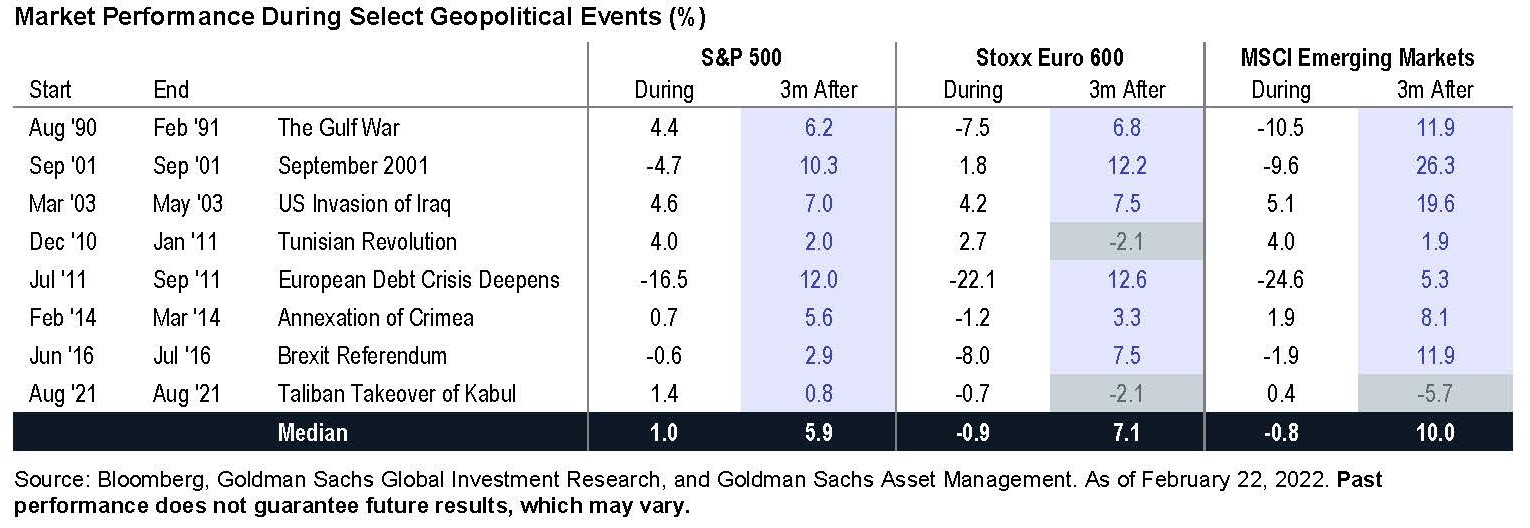

As surprising as it may seem, geopolitical conflict doesn’t always translate into severe or extended market losses. To the contrary, a review of major events over the past several decades shows these moments have resulted in mixed reactions from stocks. More importantly, the market proved resilient and usually rewarded those who remained patient.

Avoid Selling Into Weakness

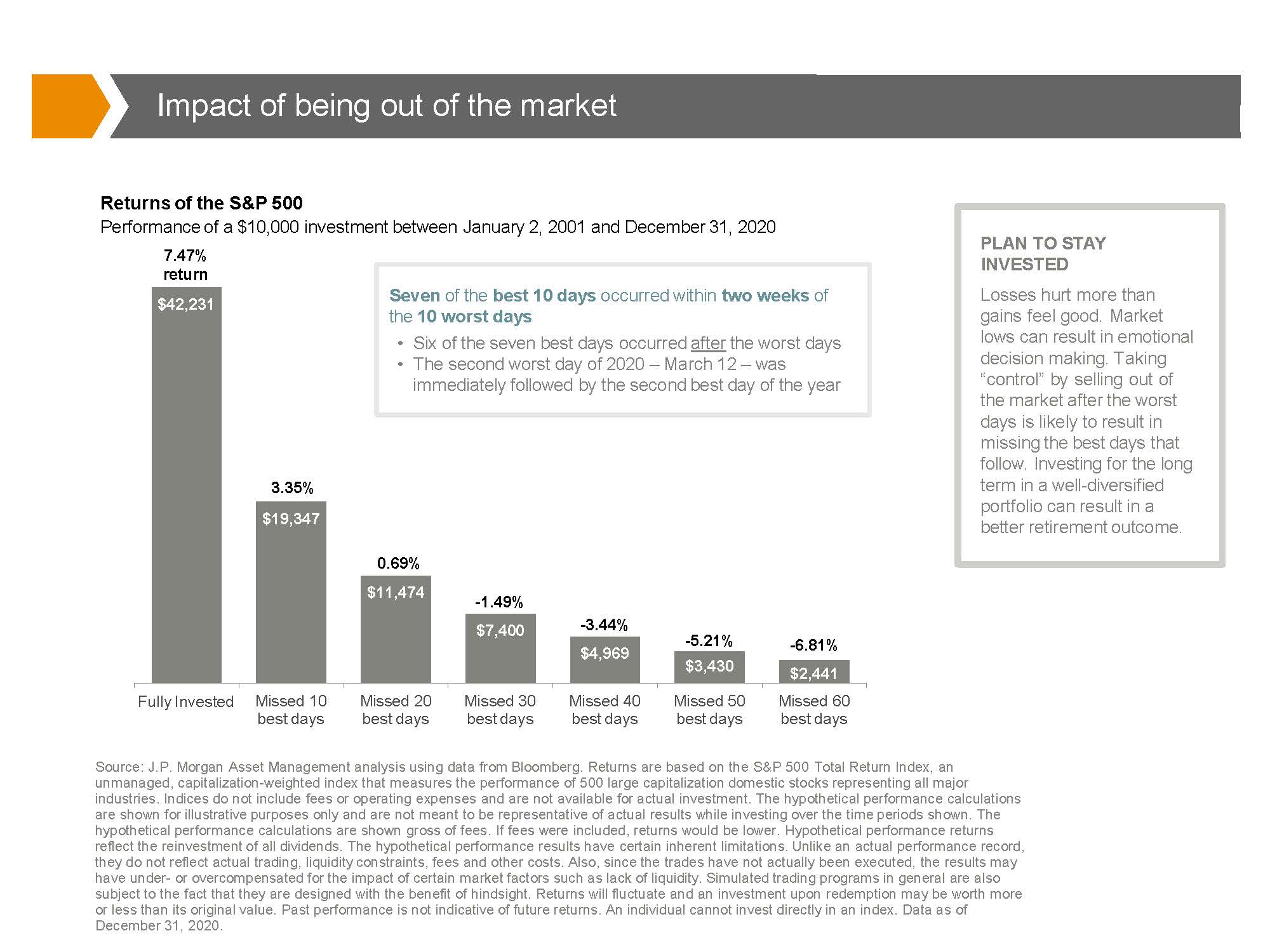

We understand that you may be feeling nervous about market turmoil, and that the pain of a loss can be more powerful than the good feelings from gains. The importance of resisting the emotional pull of the moment cannot be overstated. The impact of poor market timing can be devastating on investor returns. According to the chart below, the performance of a $10,000 investment in the S&P 500 Index between 1/2/2001 and 12/31/2020 was 7.47% if it was kept in the market. But if only the 10 best days were missed, the returns dropped by more than half, down to 3.35%. Selling out of a declining market is a good way to ensure you miss the strongest recovery days, because they occur so close together.

Bottom Line: Trust the Process

During times of uncertainty, the best investment is a strong process and a long-term perspective. You’ve heard us say it before, but it bears repeating: Staying dedicated to a diversified portfolio aligned to your financial goals and risk tolerance will keep you on track over time, no matter what the market brings.

We are comforted by the consistent effort we put forward to find investment opportunities for our clients to go beyond the typical stock and bond portfolio. Our investments in private credit, real assets, private real estate, private equity and structured notes add to the diversification we refer to above and are especially relevant now as the geopolitical and the inflationary environment are in flux.

As always, we’re monitoring the situation closely and we are available to talk with you if you have any questions.

If you have any questions or would like to have a conversation, please reach out to us or your portfolio manager.

The Cornerstone Team

Disclosure: Cornerstone Advisory, LLC, is registered as an investment adviser with the SEC. The firm only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment or strategy will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals, and economic conditions may materially alter the performance of your portfolio.